In the ever-evolving landscape of financial trading, MetaTrader 5 (MT5) stands out as a powerful and versatile trading platform. One of its most intriguing features is multi-currency testing, which can revolutionize how traders approach strategy development and performance evaluation. In this article, we will delve into the multi-currency testing feature in MetaTrader 5, explore its benefits, and discuss how it can significantly enhance trading strategies.

Multi-Currency Testing in MetaTrader 5

What is Multi-Currency Testing?

Multi-currency testing is a sophisticated feature within MetaTrader 5 that allows traders to backtest their trading strategies across multiple currency pairs simultaneously. Unlike traditional single-currency testing, which evaluates a strategy on a single asset, multi-currency testing provides a more comprehensive analysis by incorporating various currency pairs into the testing process. This feature is particularly useful for traders who use strategies that involve correlations between different currencies or those who want to evaluate the robustness of their strategies under different market conditions.

How Does It Work?

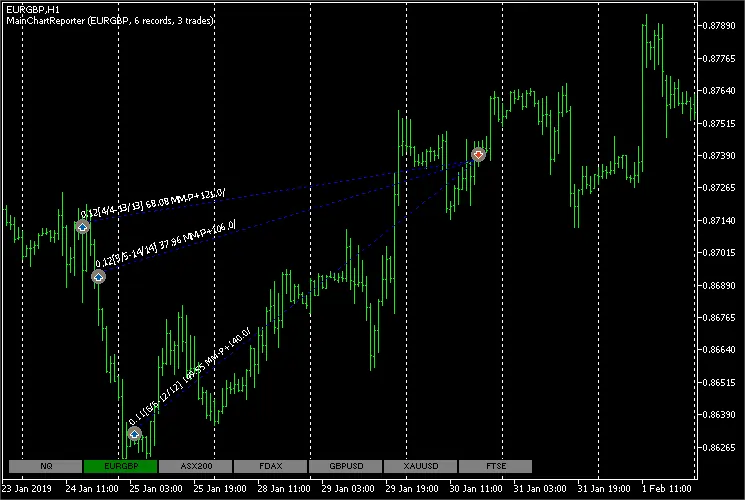

In MetaTrader 5, multi-currency testing is conducted through the Strategy Tester tool. This tool is designed to simulate trading strategies based on historical data. By leveraging multi-currency testing, traders can test their strategies across different currency pairs and timeframes within a single testing session. This approach helps identify how a strategy performs in varied market conditions and with different currency pairs, offering a broader perspective on its potential effectiveness.

Benefits of Multi-Currency Testing in MetaTrader 5

Comprehensive Strategy Evaluation

One of the most significant advantages of multi-currency testing in MetaTrader 5 is the ability to conduct a comprehensive evaluation of trading strategies. Testing across multiple currencies enables traders to understand how their strategies might perform in different market environments. For instance, a strategy that works well with the EUR/USD pair may not be as effective with the GBP/JPY pair. Multi-currency testing helps uncover these nuances, allowing traders to refine their strategies for better overall performance.

Improved Risk Management

Risk management is a crucial aspect of trading, and multi-currency testing in MetaTrader 5 can enhance it by providing insights into how strategies handle different risk scenarios. By testing across multiple currencies, traders can gauge how their strategies perform under various market conditions, including high volatility and low liquidity. This information is invaluable for developing strategies that are resilient to adverse market movements and for optimizing risk management techniques.

Enhanced Strategy Optimization

Optimizing trading strategies is a key factor in achieving consistent profitability. Multi-currency testing in MetaTrader 5 allows traders to identify the optimal settings and parameters for their strategies across various currency pairs. This process helps traders fine-tune their strategies to achieve better results, whether through adjusting risk levels, trade sizes, or entry and exit points. By using multi-currency testing, traders can ensure their strategies are robust and adaptable to different market conditions.

Time Efficiency

Backtesting trading strategies can be a time-consuming process, especially when evaluating them across multiple currency pairs individually. MetaTrader 5’s multi-currency testing feature streamlines this process by allowing traders to conduct tests on multiple currencies simultaneously. This not only saves time but also provides a more efficient way to assess strategy performance across different markets.

How to Use Multi-Currency Testing in MetaTrader 5

Setting Up the Strategy Tester

To utilize multi-currency testing in MetaTrader 5, traders need to access the Strategy Tester tool from the platform. Here’s a step-by-step guide on how to set it up:

- Open MetaTrader 5: Launch the MT5 platform on your computer.

- Access the Strategy Tester: Click on the “View” tab in the main menu and select “Strategy Tester” from the drop-down menu.

- Select the Expert Advisor (EA): Choose the EA or trading strategy you want to test from the list of available options.

- Configure Multi-Currency Testing: In the Strategy Tester window, select the “Multi-Currency” tab. This option allows you to add and configure multiple currency pairs for testing.

- Set Testing Parameters: Configure the testing parameters, including the testing period, timeframe, and other relevant settings. You can also specify the currency pairs and adjust their weights based on your strategy’s requirements.

- Run the Test: Click the “Start” button to initiate the multi-currency testing process. MetaTrader 5 will simulate the strategy across the selected currency pairs and generate a comprehensive report on its performance.

Analyzing Results

Once the multi-currency testing is complete, MetaTrader 5 provides detailed reports and performance metrics. These include overall profitability, drawdowns, win/loss ratios, and other key statistics. Analyzing these results helps traders assess the effectiveness of their strategies and identify areas for improvement. Pay close attention to how the strategy performs with different currency pairs and market conditions to make informed decisions about further optimization.

Tips for Effective Multi-Currency Testing

Choose Relevant Currency Pairs

When setting up multi-currency testing in MetaTrader 5, select currency pairs that are relevant to your trading strategy. Consider including pairs that are highly correlated or those that you frequently trade. This approach ensures that the testing results are meaningful and aligned with your trading objectives.

Adjust Testing Parameters

Customize the testing parameters based on your strategy’s characteristics. For example, if your strategy relies on specific market conditions, adjust the timeframe and testing period accordingly. This customization helps obtain more accurate and relevant results.

Analyze Historical Data

MetaTrader 5 relies on historical data for backtesting, so ensure that you have access to accurate and comprehensive data for the currency pairs you are testing. High-quality historical data enhances the reliability of the testing results and provides a clearer picture of how your strategy might perform in real trading scenarios.

Continuously Refine Strategies

Multi-currency testing is not a one-time process. Continuously refine and optimize your trading strategies based on the insights gained from testing. Regularly updating your strategies helps adapt to changing market conditions and improves overall trading performance.

MetaTrader 5’s multi-currency testing feature is a game-changer for traders looking to enhance their strategy development and performance evaluation. By allowing traders to test strategies across multiple currency pairs simultaneously, MT5 provides a comprehensive view of how strategies perform in varied market conditions. The benefits of multi-currency testing include improved strategy evaluation, better risk management, and enhanced optimization. By effectively utilizing this feature, traders can develop more robust and adaptable strategies, ultimately leading to greater success in the financial markets. Embrace multi-currency testing in MetaTrader 5 and take your trading to the next level.